Is Disney Stock a Magical Buy After Earnings?

Entertainment leader The Walt Disney Company (DIS) recently reported solid profitability gains in its third-quarter results. The company also stands on the cusp of a significant acquisition of the NFL Network.

With Q3 results in the rearview and an exciting deal on the way, should investors play DIS stock now? Or should they hold off on buying shares of the entertainment giant?

About Disney Stock

Founded in 1923, the Walt Disney Company is a global leader in the entertainment and media industries. Headquartered in Burbank, California, the company owns iconic brands such as Disney, Pixar, Marvel, Star Wars, and National Geographic. Its operations encompass television broadcasting, film production, merchandise licensing, and digital platforms, including Disney+. The company also runs internationally renowned theme parks and resorts. Disney has a market capitalization of $209 billion.

A transformation is underway in Disney’s sports segment, with its ESPN subsidiary launching a sports streaming service for customers on Aug. 21. This service brings the full suite of ESPN’s network under one umbrella. The launch of the service is timed to coincide with numerous sports events, including the start of the NFL season.

This also brings the bombshell news that ESPN would be acquiring the NFL Network, which has nearly 50 million subscribers, and other media assets. The addition of the NFL streaming rights gives the company more leverage for its upcoming sports streaming service.

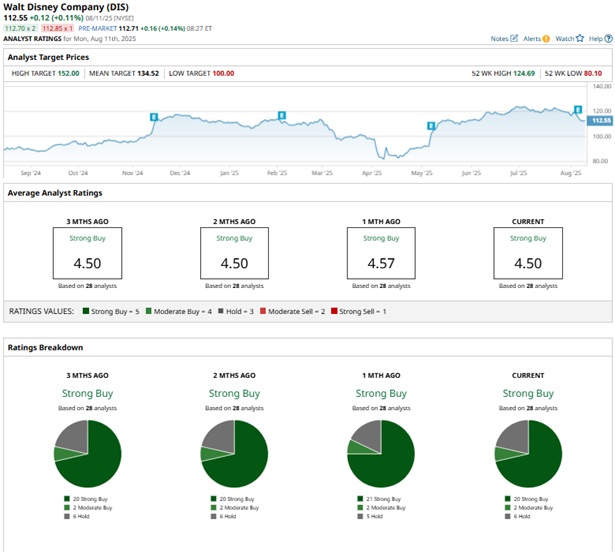

Over the past 52 weeks, DIS stock has gained 34% as the company experiences growth in subscribers. DIS stock reached a 52-week high of $124.69 in late June but is now 8% off that mark. So far this year, the stock is up by nearly 4%.

Right now, shares of Disney trade at an attractive valuation. Its price sits at 19.3 times forward earnings, which is lower than the current industry average.

Disney’s Profits Climbed in the Third Quarter

Disney reported robust third-quarter results for fiscal 2025 on Aug. 6. The company’s revenue increased by 2% from the prior-year period to $23.65 billion. However, this figure fell just short of the $23.68 billion that Wall Street analysts were expecting.

At the heart of the growth was Disney’s growing subscriber count in its streaming services and growth in its domestic theme parks segment. The company’s total Disney+ subscribers for the quarter were 127.8 million, increasing 1.4% from the prior quarter.

This subscriber growth was, in turn, fueled by a 2.5% sequential increase in international subscriber count, while domestic subscriber growth (in the U.S. and Canada) remained flat. Its total Hulu subscriber count grew by 1.5% sequentially to 55.5 million.

Disney’s direct-to-consumer (DTC) segment’s operating income stood at $346 million, representing a significant turnaround from the $19 million operating loss it had reported a year earlier. On top of that, the experiences segment’s operating income climbed by 13% year-over-year (YOY) to $2.52 billion.

The company also reported gains in its profitability as its operational metrics grew. Adjusted EPS grew by 16% YOY to $1.61, which was higher than the $1.46 per share that Wall Street analysts were expecting for the quarter.

For Q4, Disney expects total Disney+ and Hulu subscriptions to increase by more than 10 million compared to the third quarter. The majority of the growth is likely to come from Hulu due to its expanded Charter deal, while the Disney+ subscriber count is expected to grow modestly.

For the current fiscal year, Disney expects adjusted EPS to be $5.85, representing an 18% increase from the prior year. Its DTC segment is forecast to report an operating income of $1.30 billion.

Wall Street analysts are soundly optimistic about Disney’s future earnings. For the current fiscal year, EPS is projected to increase 18.3% annually to $5.88, followed by 10% growth to $6.47 in the next fiscal year.

What Do Analysts Think About Disney Stock?

In the eyes of Wall Street analysts, Disney remains a sweetheart in the entertainment industry. Recently, Rosenblatt raised its price target on DIS stock from $140 to $141, while maintaining a “Buy” rating. The price target revision came after the company’s Q3 report, with Rosenblatt analysts highlighting its theme park growth.

Needham analyst Laura Martin also maintained a “Buy” rating on DIS stock with a $125 price target. The rating is based on several positive developments, such as Disney's recent profitability gains.

Reflecting positive sentiment, Evercore ISI Group analyst Vijay Jayant maintained an “Outperform" rating, hiking the price target from $134 to $140. Expecting the company to continue its track of sustained earnings growth, Morgan Stanley analyst Benjamin Swinburne raised the price target from $120 to $140 as well, with an unchanged “Outperform” rating.

Disney remains a favorite on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 28 analysts rating the stock, a majority of 20 analysts rate it a “Strong Buy,” two analysts suggest a “Moderate Buy,” and six play it safe with a “Hold” rating. The consensus price target of $134.52 represents 17% potential upside from current levels. The Street-high price target of $152 indicates 32% potential upside from here.

The Bottom Line

Disney’s operations might be in a growth phase at the moment, with growing subscribers and additions in theme parks, such as the company's planned seventh theme park set to be built in Abu Dhabi. Disney’s bottom-line gains are also notable. Therefore, investors may want to consider DIS stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.