DoorDash Stock Outlook: Is Wall Street Bullish or Bearish?

DoorDash, Inc. (DASH) is a technology company headquartered in San Francisco, California, operating primarily in the online food ordering and delivery sector. Its market cap currently stands at $109.4 billion.

DoorDash connects consumers, merchants, and delivery contractors via its proprietary platform, offering services, like the DoorDash Marketplace, subscription programs (DashPass), white‑label fulfillment, and merchant tools.

DoorDash’s shares have delivered strong outperformance both year‑to‑date (YTD) and over the past 52 weeks, significantly outpacing broader benchmarks. DASH stock has gained 53.9% YTD, compared with the S&P 500 Index’s ($SPX) modest 7.9% return. Over the past year, DoorDash has soared 110.4%, versus a 21.1% total return for the S&P 500 index, and hit a high of $259.87 on Aug. 5.

The Consumer Discretionary ETF (XLY), which reflects the sector DoorDash operates in, posted a slight decline on a YTD basis and a 29.1% total return over the past year, far behind DASH’s surge.

Several key catalysts help explain DoorDash’s exceptional momentum. The company’s Q1 earnings report, released on May 6, posted revenue growth of 21% year‑over‑year (YoY), and the company swung to profitability. Its strategy has also included major acquisitions such as Deliveroo and SevenRooms, which are expected to substantially expand its international footprint and enhance its merchant services platform.

Then came the Q2 report recently, and the story leveled up. DoorDash didn’t just meet expectations, it blew past them. Revenue surged 25% to $3.3 billion, and the company flipped last year’s loss into a solid $0.65 profit per share. The quarter also marked a series of milestones: record highs in Total Orders, Marketplace GOV, and GAAP net income. Plus, it hit 10 billion lifetime orders globally. It wasn’t just a good quarter – it was a victory lap, and the market responded accordingly.

For the current fiscal year, ending in December 2025, analysts expect DASH to report EPS growth of 648.3% YoY to $2.17, on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast in two other quarters.

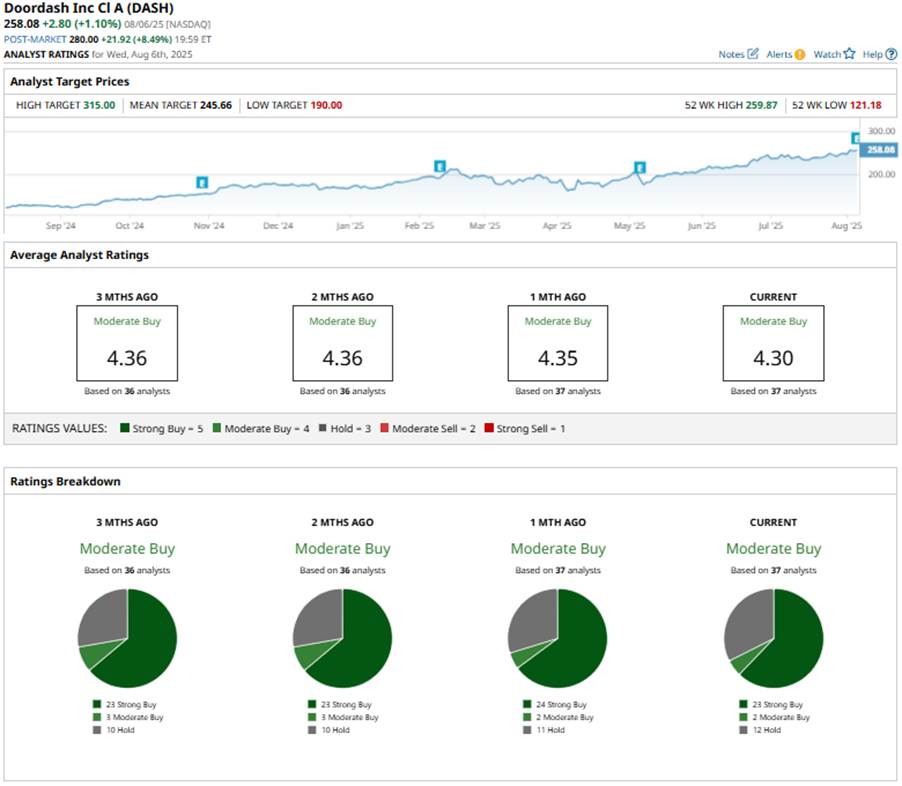

Among the 37 analysts covering DASH stock, the consensus rating is a “Moderate Buy.” That’s based on 23 “Strong Buy,” two “Moderate Buy,” and 12 “Hold” ratings.

The current configuration has mainly remained consistent over the past few months.

Recently, analyst Mark Zgutowicz from Benchmark has raised DASH's price target to $315, up from the prior target of $260.

Although DASH is trading at a premium to its average analyst price target of $245.66, the Street-high target of $315 signals that DASH can still rise as much as 22.1% from current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.