Deckers Outdoor Stock: Is DECK Underperforming the Consumer Cyclical Sector?

/Deckers%20Outdoor%20Corp_%20Hoka%20shoe%20by-%20Stefan%20Pinter%20via%20Shutterstock.jpg)

With a market cap of $15.2 billion, Deckers Outdoor Corporation (DECK) designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities. Based in Goleta, California, the company owns a portfolio of brands including UGG, HOKA, Teva, Sanuk, Koolaburra, and AHNU.

Companies worth $10 billion or more are generally labeled as “large-cap” stocks, and Deckers Outdoor fits this description perfectly. The company serves a global customer base and sells its products through domestic and international retailers, as well as directly to consumers via e-commerce websites and retail stores. It is recognized for its focus on innovation, comfort, and brand loyalty.

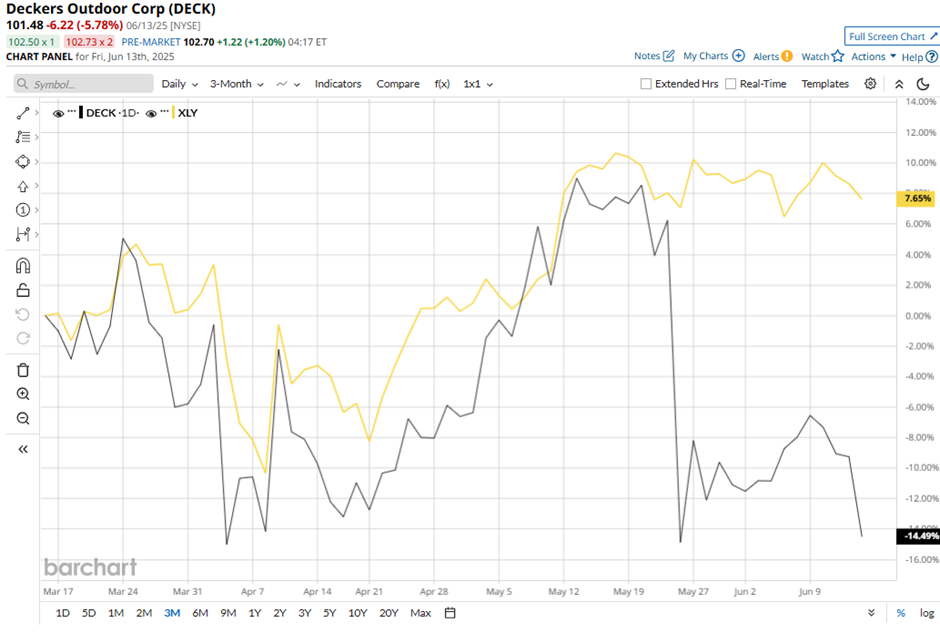

Shares of Deckers Outdoor have dipped 54.7% from its 52-week high of $223.98. DECK stock has declined 13.3% over the past three months, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 9.9% increase.

In the longer term, Deckers Outdoor’s stock has dropped 50% on a YTD basis, significantly lagging behind XLY’s 5.6% decrease. Additionally, over the past 52 weeks, shares of DECK have collapsed 40.9%, compared to XLY's 17.8% return.

Despite recent fluctuations, the stock has been trading below its 50-day and 200-day moving averages since February.

Despite beating Q4 2025 estimates with EPS of $1 and revenue of over $1 billion on May 22, Deckers’ stock plunged 19.9% the next day due to disappointing forward guidance. Management projected Q1 revenue of $890 million - $910 million and EPS of $0.62 - $0.67, both significantly below consensus. Additionally, Hoka's sales growth slowed sharply to 10% from 23.6% for the full year, raising concerns about decelerating momentum in one of its key brands.

Compared to its rival, Birkenstock Holding plc (BIRK) has outpaced DECK stock. Shares of BIRK have decreased 9.1% on a YTD basis and 14.1% over the past 52 weeks.

Despite DECK’s underperformance, analysts are moderately optimistic about its stock’s prospects. DECK has a consensus rating of “Moderate Buy” from the 21 analysts covering the stock, and as of writing, it is trading below the mean price target of $129.28.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.